OPEN API TECHNOLOGY

OPEN API TECHNOLOGY THAT WILL DEFINE BANKING IN ۲۰۱۹

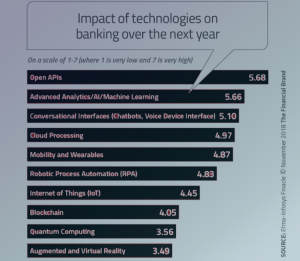

It is a known fact that the drive of development is the concept called innovation. In its modern definition, it is a creative new idea or thought. It is an imagination by an individual or group passed across to the public in form of device or method. Due to existing needs and updated requirements, the application of a better solution is always needed in any field. This led to an innovation such as Open API Technology in the banking sector.

WHAT IS AN OPEN API TECHNOLOGY?

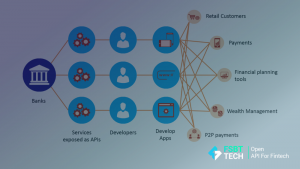

It is literally an application programming interface technology, and its importance and relationship with open banking is not farfetched. Open banking is a system or strategy employed by banks using API technology to provide customers with the privilege to have a network of financial institution data. This privilege enables customers (third-party developers) to develop application and services around the financial institutions using the technology. Financial transparency is upheld higher by account holders because of this technology.

OPEN API TECHNOLOGY IN EUROPEAN AND WORLD BANKING SECTOR

The acceptance and use of open API technology in European countries and the world at large varies, and this is as a result of the earlier traditional banking method adopted by the country. The U.S. is in the early stages of having an ecosystem built around open banking, while Europe has had PSD2 [the revised Payment Services Directive]. There is open banking in the U.K, and European banks have a head start on the U.S. in terms of getting the frameworks and the technology in place. There have been some gaps in terms of understanding by the general public about what open banking actually is. If there were a use case for sharing your data, most people understand, but the ecosystem around it is still coalescing.

When you look at Europe or Australia, for example, or Canada and Mexico, these are countries that are leading with regulators. Regulators and governments have come together, and they have a strong seat at the table. Australia, for instance, has a singular consumer data right. They’re starting with open banking as the first vertical, and then moving into energy and telecommunications. The U.S. is much more of an industry-led solution versus a government-led solution. It is by far the most complex banking model in the world — there is a lot of momentum, but it’s still relatively early days.

WHY ALMOST EVERY EUROPEAN AND WORLD BANKS WOULD ADOPT THE OPEN API TECHNOLOGY IN ۲۰۱۹

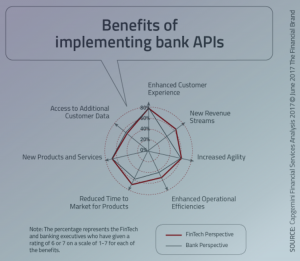

We have some data on return on investment from both the institutional perspective and the individual perspective. We have seen that when someone can access their data and is given access to tools, their financial strength improves. Institutions spend a lot of money acquiring customers and cross-selling to customers. Instead of this, institutions could focus on reducing high-interest debt, increasing deposits, moving customers up the value chain, and increasing the value of products — this will lead them to the use of API technology.

There is now so much more competition to be customers’ primary financial institution. If financial institutions can organize themselves around customer outcomes, they will be able to retain that primary financial institution status. However, if they continue to cross-sell a bunch of products, then it’s going to be downhill for them. To avoid this downhill, they must adopt the more open API technology banking.

Introduction of APIs is definitely going to bring improvements in banking services. We are seeing giant financial institutions engaging in a deep way with the system from a contractual perspective. The data aggregators, who have traditionally been the middle men between the fintechs and the APIs, are doing a lot more direct connection. People no longer have to share their credentials, thus having much more secure engagements.

The open banking is the major source of innovation in the financial sector. One of its benefits is that it facilitates the very stressful and boring process of switching from using one bank’s checking account service to another. The API can also look at customers’ transaction data to identify the best financial products and services for them, such as a new savings account that would earn a higher interest rate than the current savings account, or a different credit card with a lower interest rate. Through the use of networked accounts, open banking could also help lenders get a more accurate picture of a consumer’s financial situation and risk level in order to offer more appropriate loan terms. It could also help consumers get a more accurate picture of their own finances before taking on debt. Lastly, open banking can help small businesses save time through online accounting, and help fraud detection companies to be more effective in monitoring customers’ accounts and identify problems more expeditiously.

ACTIVITIES OF FINTECH AND E-WALLET COMPANIES INVOLVING API TECHNOLOGY IN OPEN BANKING

Already, one third of all banking customers are using some sort of external fintech apps. Open banking is a concept that leans on the new concept and posits that third-parties should have access to bank data to build applications that create a connected network of financial institutions and third-party providers. An example is the all-in-one money management tool. Another example of API innovation used by fintech firms is the truelayer, which allows fintech firms to now directly access financial data from a variety of Open Banking APIs in one single platform. This is about turning ideas into applications that use transaction data with a few lines of code so that the clients can focus on what matters.

FSBT OPEN BANK PROJECT API

Due to the decisive changes happening in the financial sector, an idea gave second birth to this project, which is to provide the needed technical report that more efficient and smaller financial service providers will need. This gave rise to an open source API infrastructure that new firms can use to rapidly develop, test, and deploy their digital service offerings. Also, old and modern firms can check out our full list of API of good standard for the financial sector.

source: https://medium.com/fsbtapi/open-api-technology-that-will-define-banking-in-2019-aefca7122e71

اشتراک